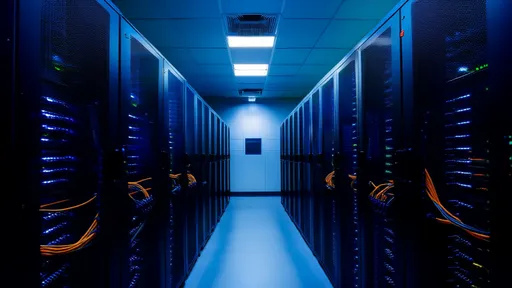

The global shift toward modular data center solutions has introduced a new paradigm in infrastructure economics, challenging traditional capital expenditure models. As enterprises grapple with escalating digital demands, the deployment cost framework for these prefabricated systems reveals surprising nuances that defy conventional wisdom. Industry leaders now recognize that the true financial picture extends far beyond simple comparisons of per-rack pricing between brick-and-mortar facilities and their modular counterparts.

Site preparation expenses often emerge as the silent budget killer in modular deployments, though this varies dramatically by geography. While modular designs theoretically reduce civil works, projects in flood-prone areas or regions with extreme temperatures still require substantial ground stabilization and environmental hardening. The paradox lies in how these site-specific adaptations can sometimes erode 15-20% of the projected savings from off-site construction methods. Engineers have observed that the most cost-effective deployments occur when organizations align module specifications with existing land conditions rather than forcing standardized designs onto incompatible terrain.

Transport logistics present another layer of complexity that financial models frequently underestimate. The last-mile delivery challenges for multi-module deployments can escalate costs unpredictably, particularly when oversized components require road closures or special permits. There's growing evidence that regional module fabrication hubs may soon disrupt current transportation cost assumptions, with several hyperscalers already experimenting with localized assembly approaches. This geographical production strategy could potentially neutralize one of the last remaining price advantages of traditional data center builds.

Power infrastructure integration costs remain the most volatile variable in modular deployment budgets. The industry is witnessing a fascinating divergence between organizations opting for self-contained power modules versus those integrating with centralized utility systems. While all-inclusive power modules simplify deployment, they often lock buyers into specific vendor ecosystems for maintenance. Conversely, facilities that tie into municipal grids face unpredictable interconnection fees that can vary by 300% depending on local utility policies. Several recent deployments have been delayed not by technology issues, but by protracted negotiations with utility providers over step-down transformer requirements.

The operational expenditure profile of modular data centers continues to surprise financial analysts. Traditional models predicted 20-30% lower operating costs, but real-world data shows much wider variance. Facilities in humid climates report higher maintenance frequencies for modular environmental systems, while deployments in arid regions achieve better-than-expected efficiency. Perhaps most surprisingly, insurance premiums for modular installations remain stubbornly high, with underwriters citing concerns about concentrated asset values in compact footprints. This insurance premium gap may persist until the industry accumulates more long-term performance data.

Scaling economics behave differently in modular environments compared to traditional builds. The anticipated linear cost progression for adding modules often fails to materialize due to hidden integration complexities. Each additional module typically requires new interconnects, security systems, and management layer expansions that create cost step functions. Some operators now advocate for "over-modularization" during initial deployment to avoid these nonlinear cost jumps during expansion phases. This approach, while increasing upfront capital requirements, appears to yield better total cost of ownership over 5-7 year horizons.

The workforce cost equation has flipped multiple times since modular solutions entered the mainstream. Early adopters banked on significant labor savings, only to discover that specialized module integration skills commanded premium wages. Now, as best practices become standardized, we're seeing a new equilibrium emerge. Certain maintenance tasks indeed require fewer personnel, but the critical difference lies in workforce flexibility - modular facilities enable more strategic staffing models that align personnel costs with actual capacity utilization rather than fixed infrastructure footprints.

Financial analysts are developing new metrics to evaluate modular deployment economics, moving beyond simple cost-per-kilowatt comparisons. The concept of "economic density" has gained traction, measuring how effectively a deployment monetizes its physical footprint across multiple dimensions. Similarly, "adaptation cost" - the expense required to repurpose modules for different workloads - is emerging as a crucial factor in total cost calculations. These refined metrics better capture the operational agility that originally made modular solutions attractive, but which simplistic financial models often overlooked.

As the market matures, secondary markets for refurbished modules are beginning to influence initial deployment economics. Forward-thinking operators now factor potential resale value into their capital budgeting, with some achieving 30-40% cost recovery on decommissioned modules through specialized marketplaces. This emerging circular economy for data center components could fundamentally change depreciation schedules and investment timelines. However, the market remains fragmented, with significant valuation disparities between geographies and module specifications.

The most sophisticated cost models now incorporate risk mitigation values that are unique to modular approaches. The ability to geographically distribute critical workload modules across multiple sites provides measurable business continuity benefits that traditional single-site facilities cannot match. Quantifying this distributed risk advantage remains challenging, but several financial institutions have begun assigning concrete value to these operational resilience characteristics during their investment analyses.

Looking ahead, the next generation of modular data center economics will likely be shaped by two converging trends: the integration of renewable energy microgrids and the rise of edge computing demands. Early indications suggest that modular designs may hold inherent advantages in both areas, potentially unlocking new cost optimization frontiers. However, these emerging applications will require fresh financial models that account for radically different utilization patterns and infrastructure interdependencies compared to current deployment paradigms.

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025

By /Jul 11, 2025